|

|

cyberbarf VOLUME 15 NO. 10 EXAMINE THE NET WAY OF LIFE MAY, 2016 ©2016 Ski Words, Cartoons & Illustrations All Rights Reserved Worldwide Distributed by pindermedia.com, inc. |

According to Nerdist.com, all of the original creators are back on this project. Series creator Kazuya Tsurumaki will team up with Production I.G., the high quality anime company that originally produced the series to produce the updated FLCL. The new series will be set some time way in the future, where the war between the evil conglomerate Medical Mechanica and a new entity called Fraternity is raging in outer space. A new young person, a girl named Hidomi, thinks everything in her little town will always be boring and average, until a new teacher comes to town - - - a teacher named Haruko. Let us hope that it is not a re-telling of the old story with a few new characters. This baseline plot opening may be to introduce new viewers to the old elements of the show most may not have seen. The original series is still entertaining on subsequent binge views. (We recommend the FLCL Utimate Edition). Though the characters are exaggerations of character traits you would find in any town, in all the bizarre action there are strong story foundations that slowly unravel to give the viewer insight in the human condition: abandonment, family, fear, longing, anger and purpose. In some ways, it is a coming of age story - - - but not just for the main character, Naota, but also for the characters close to him. We can hardly wait for the new series to premiere. The original series packed in a lot of action and character development into six episodes. The current schedule calls for two series of six episodes each. Double the Fooly Cooly, double the fun!

|

|

“Life has no meaning. All we have is desire.” - - - Charlie Chaplin |

NEW EPISODE: |

|

|

|

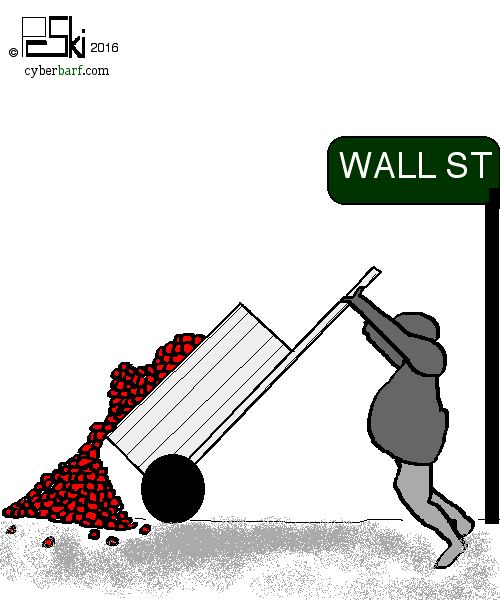

cyberbarf PULLING THE APPLE CART ESSAY

But in order to continually to pay dividends, Apple had a problem. Most of its revenue was now being made overseas. Under current U.S. tax law, if a company wants to re-patriot its overseas earnings, it has to pay full corporate income tax of those transfers (which can be 35 percent tax on the privilege of bringing your own money home.) One solution is to leave the foreign cash stashed in overseas accounts by borrowing money in the US for the sole purpose of distributing it as dividends. Wall Street loved the idea because Wall St. firms would be paid fees to issue and sell these Apple bonds. As you can tell, Wall Street's motives are not the same as Apple's core principles. Financial firms make money by buying and selling stocks (and making good and bad reports, earnings estimates or critical predictions which affect stock prices) and by selling securities (corporate bonds). Apple did none of these things in the past. It was against its corporate culture of being a self-sufficient organization. In another move to appease certain large shareholders, Apple used its massive excess cash reserves to buy back billions of dollars worth of stock. Again, Jobs would have believed that it would be a waste of corporate assets to retire shares of stock. But corporate financial people find these tricks beneficial for insiders. By reducing the number of outstanding shares of corporate stock, the company's price/earnings ratio (a Wall St. staple for share valuation) would increase because earnings per share would be inflated because there are less shares on the books. Also, retiring public shares allows corporate employees who have stock options more control of the company. Jobs did not like the corporate politics of balance sheet and stock manipulations. He believed it was a distraction. But in today's board rooms, these types of deals are like oxygen. One could discount the corporate governance, the dividend, the stock buy-backs and borrowing as currently acceptable accounting and financial management tools that all of the Fortune 1000 companies do. So long as Apple is generating tens of billions of dollars in hard earnings every quarter, no one seems to care about these inside side issues. These issues used to have very little in the Apple culture of product development. But the company continued to listen to the outside drone. Analysts and tech pundits questioned Cook's leadership and product creativity. They opined that Cook's Apple would never be as great as Jobs' legacy until Cook developed his own new products. So against Jobs' past views, Apple soon built a bigger screen iPhone. Then, because everyone else had a tablet, Apple created iPads. Then, because wearable tech was going to be the next great thing, commentators badgered Apple into creating the Apple Watch. Apple has become reactionary to outsider's views on what products Apple should develop and market. This is a complete reversal of the Jobs philosophy. It is true that Jobs had a vision that Apple would place itself as the hub of a person's digital lifestyle, he would have not felt the pressure of public opinion to put out a new iPhone every six months, or making huge advances in laptops or tablets every year, or to create a new product like the watch which no actual consumers were clamoring for to supplement their iPhone experience. The same holds true for the weekly reports and rumors about the Apple Car. Even though it makes little practical sense for Apple to build cars, the constant drum beat is that Apple needs to create an expensive and risky new product line in order to keep up with Google's self-driving vehicles, Amazon's use of delivery drones or Tesla's future electric cars. Except, if you look at the automotive market - - - it is highly competitive with high end manufacturers ebb and flow with the whims of consumer fads, extreme regulatory hurdles and high unionized labor costs in production and assembly. Despite all the great press, Tesla Motors has yet to make a profit. Amazon's delivery drone concept is facing burdensome FAA regulations. And the Google self-driving car is counter-intuitive to why people spend $50,000 for their vehicles - - - to drive them. The Apple Car is a perfect bear trap. Just as Wall Street likes to build up companies as the greatest thing since sliced bread (i.e., IPOs), Wall Street likes to sell companies short with bad news (whether real or imagined). The same people who wanted Apple to create and sell its high tech and expensive watch, now pan it as being a slow selling novelty. That is the celebrity media culture at work: build up something in order to tear it down. There are many product lines that Apple has put into the “other” or hobby category (which contributes very little to the bottom line): Apple Music and Beats; Apple Radio; Apple TV; and the old dog iTunes, which is being hinted at a possible revamp. Why would a company like Apple even listen to people who have never created a mega product in their lives? Of if they were so smart and brilliant, why don't they make their own Hi-Tech Car and keep the profits for themselves? Because it is easier to be an armchair quarterback and make money watching stock charts rise and fall on rumors and unfounded expectations. The pressure on global executives is measured by their company's stock price. Their golden parachutes and retirement plans are top heavy with their own stock so there is an inherent conflict of interest on what is best for the company: meeting Wall Street expectations and product cycle hits or sticking to one's own internal product strategies and release dates? The attempts to meet these outside expectations has led to buggy software releases, marginal upgrades to iPhone features, and the movement away from long time desktop creative customers needs to force mobile OS on everyone. But not everything is dire. Down played in most reports is the fact that Apple's non-traditional services are producing rapidly increasing profits. Its cloud services and Apple Pay are keys to long term sustained company growth. Those were the key reasons why Cook took such a hard stand against the FBI on its encryption court orders. Apple needs to secure its customers data and payment options otherwise this business segment will implode. Apple will continue to be the great American success story. It should just listen to its internal heart beat than trying to please everyone. Note: Publisher Ski is an Apple shareholder. |

|

cyberbarf THE WHETHER REPORT |

cyberbarf STATUS |

| Question: Whether the final legs of the presidential campaigns be fought and won on social media? |

* Educated Guess * Possible * Probable * Beyond a Reasonable Doubt * Doubtful * Vapor Dream |

| Question: Whether ID theft such as the second consecutive year at the IRS with its on-line filing returns and refunds cause a public retreat from on-line commerce? |

* Educated Guess * Possible * Probable * Beyond a Reasonable Doubt * Doubtful * Vapor Dream |

| Question: Whether the rise of personal distraction from smartphone, tablet, and 24/7 social media will dehumanize our species? |

* Educated Guess * Possible * Probable * Beyond a Reasonable Doubt * Doubtful * Vapor Dream |

|

cyberbarf EXAMINE THE NET WAY OF LIFE iToons

|

|

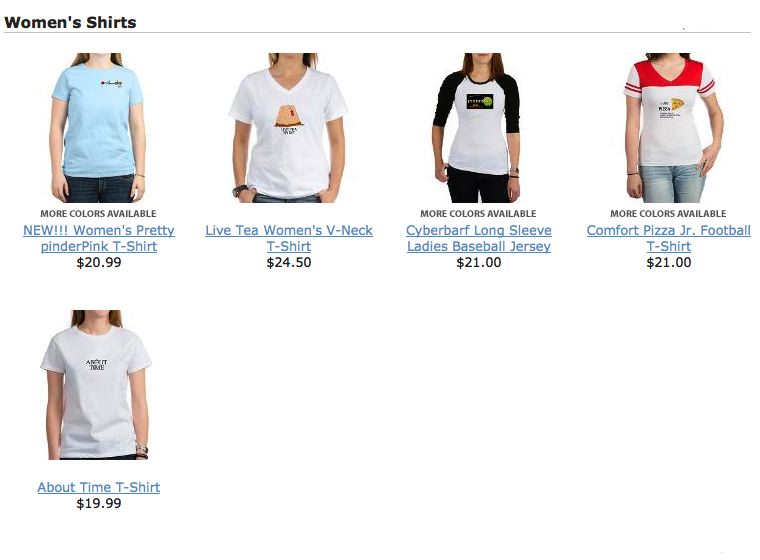

LADIES' JAMS MULTIPLE STYLES-COLORS $31.99 PRICES TO SUBJECT TO CHANGE PLEASE REVIEW E-STORE SITE FOR CURRENT SALES

|

PRICES SUBJECT TO CHANGE; PLEASE CHECK STORE THANK YOU FOR YOUR SUPPORT!

NEW REAL NEWS KOMIX! SHOW HACK! |

|

PRICES TO SUBJECT TO CHANGE PLEASE REVIEW E-STORE SITE FOR CURRENT SALES & CURRENT STYLES

|

|

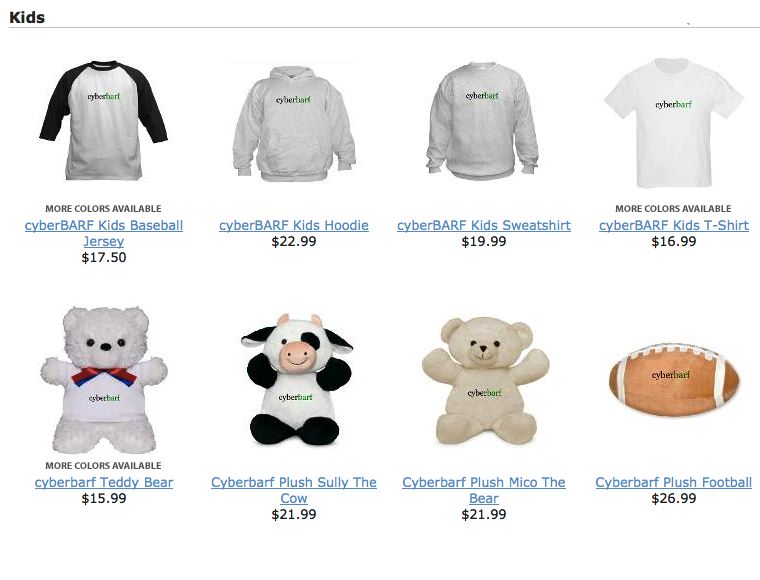

THE PINDERMEDIA STORE IS FULL OF FUN T-SHIRTS CLOTHES, HATS AND OTHER ITEMS. CHECK OUT THE STORE FOR ITEMS

SUPPORT cyberbarf VISIT THE CYBERBARF STORE! Prices and styles may vary depending on sales, allotments, inventory. |

|

BACK IN BLACK WITH THIS CLASSIC CYBERBARF T-SHIRT!

FEATURING: THE REAL NEWS IMPACT EDITORIAL CARTOONS WRIGLEYVILLE WAR POLITICS ENDORPHIN RUSH THE DARK ABYSS RANDOM ELECTRONS SPECIALS

PORTFOLIOS OF SKI EDITORIAL CARTOONS ILLUSTRATIONS PHOTOGRAPHY |

NEW THEORIES AND CHARACTER ESSAYS INCLUDING 10 YEAR ANNIVERSARY ARTICLES

cyberbarf

THE STEAM PUNK SPECIAL EDITION featured new Music from Chicago Ski & the (audio) Real News: (mp3/4:14 length)

EXAMINING THE NET WAY OF LIFE cyberbarf™ distributed by pindermedia.com, inc.

|

cyberbarf

Distribution ©2001-2016 pindermedia.com, inc.

All Ski graphics, designs, cartoons and images copyrighted.

All Rights Reserved Worldwide.