cyberbarf

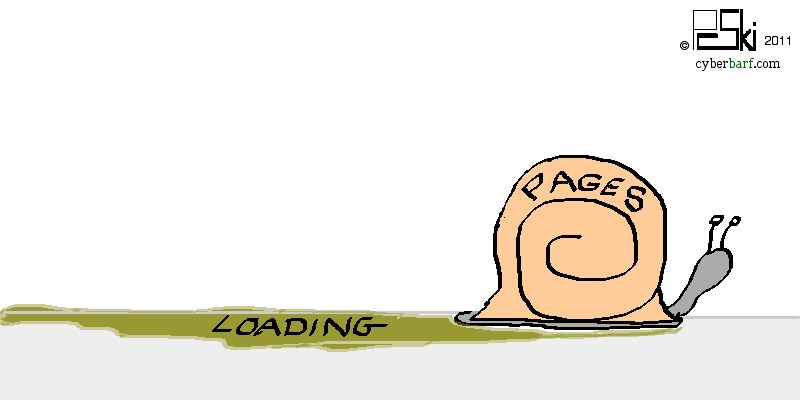

SNAIL

PACE

. . . . . . . . . .

A

spinning wheel of death, the browser cursor, spinning like a pinwheel

in a hurricane. In a high speed connection, too. Waiting. Waiting

for seemingly forever. The trend is that page loads are turning into

molasses of a 14.4 dial-up modem. And frustration is growing which

each non-response.

It

is time to equate this problem with early desk top publishing. The

power to self-create DTP newsletters and graphics flooded the internet

with graphically challenged nightmares of dozens of conflicting fonts,

poor page designs, dangling headlines, and poor content construction.

We

know the causes for these web page time-outs:

1.

looking for ad server;

2.

looking for facebook connection;

3.

loading video content.

Those

annoying pop up ads have now turned into even more annoying full screen

video ads where the (close) button is hidden from plain view. If a

page has more than two multimedia ad spaces, you are doomed to wait

until the bottlenecks and conflicts are resolved somewhere far, far,

far away from your terminal. It is like waiting a roulette wheel spin,

after its fifth minute of the ball hugging the top rail, to fall.

And it never falls on your number. The ads never do either.

Just

as teeth grinding is waiting for a facebook connection. What if you

don't care about facebook? What if you are not on facebook, as a matter

of principle or pride?? It seems like a Terminator type robotic device

to attempt to locate and destroy the human vermin that populate the

electronic planetary systems.

Like

overloaded DTP pages, there are pages that are just video windows.

Slow loading video windows. Overkill video window pages. You can't

smash your finger hard enough on the ESC key, but to little effect.

You are doomed to stall out, then crash in any browser.

It

is easy to get sucked into the Impatient Generation when web pages

load like a sand hourglass.

Just

because a page designer can throw all the bells and whistles, audio,

video, graphics and links on a single page, that does not mean he

or she should cram so much junk that an average user would rather

abort the page load and move on to an alternative site. And that is

what happens. If the page does not unfreeze after one re-set, it is

on to a different URL to find the same information or entertainment.

cyberbarf

FALSE

EMPOWERMENT PERCEPTION

The national media is crowing about the revolution in the Middle

East being caused by the power of social media. This is a false assumption.

The

real reason that Tunisia, Libya, Egypt and Yemen have turned into

centers of protest against their autocratic governments is simple:

high food prices (see, The Oil Economy), high unemployment, and corrupt

government officials. They are not shouting for democracy, but merely

change. Change is the form of a living wage, stable food prices, and

less corrupt officials.

The

boiling point of intolerance came when the educated and unemployed

youth in North Africa gave them no opportunity. The current system

was rigged against them. This was not a political movement but an

economic protest.

Technology

is only a tool to communicate instructions to protesters. But as one

Egyptian businessman said during the height of the protests, the elderly

women in the crowds of Tahrir Square were not “Internet literate.”

In fact, Egypt shut down its internal net servers early in the rallies.

It was “the will of the people” and not technology that

spurred the crowds to gather to confront the forces of their discontent.

But

American news television is a jaded lot. They have poured millions

into electronic technology, swipe screens, HD monitors and web video-Twitter

accounts. Anything that can be posted can become a graphic on the

nightly news. Television news is fueled by images and simple story

lines. So when some cell phone video of the violent clashes surfaces

on the web, the TV producers leap to the conclusion that technology

is the root cause for the revolution.

In

Libya and other countries, a protester's Twitter post cannot defeat

live bullets, police beatings or tear gas. There is no power in a

cellphone that can dismantle a police barricade or stop a tank.

Film

footage of the disturbances and street violence can change international

opinion. But the spin on such events is propaganda, for both sides.

What it takes is the internal opinion of those in power to change.

In Egypt, an old dictator decides enough is enough and flees the country

with his personal wealth. In Libya, an old dictator decides to fight

for continued control of his power by armed actions against his own

people. The one sided early Civil War in Tripoli of casualties has

caused a run of foreigners to flee the country.

The

view of the protests across the Middle East is similar to the early

battles of the American Civil War. People, families, children would

picnic on the hillsides around the early battlelines to view the “

skirmish” between the opposing armies. It was an social event.

But after the magnitude of the death and destruction hit home to those

socialites, that they would quickly flee from on-coming combatants.

For American television crews, reporting from inside the current protests

are like those early social events. Observers inside the realm of

something exciting, transforming, until the real violence hits home.

cyberbarf

THE

OIL ECONOMY COMMENTARY

Those

who believe the New Economy is based on the Internet are greatly mistaken.

The world does not run on telecommunications. It runs on petroleum.

Since

the Industrial Revolution of the late 1890s, the planet has been running

on fossil fuels to power monumental growth in technology and life

styles. The shift from a subsistent agricultural economy to a heavy

manufacturing-urban culture in less than a century is unprecedented

in human history. Coal power created the steam era. Refined oil created

the modern era.

Every

person's daily life is controlled by petroleum. The technology to

find oil such as drilling rigs. The technology to transport the crude

in tankers, barges, pipelines and trucks. The technology to refine

the crude into products like diesel, gasoline, petrochemicals and

plastics. Everything around your home is touched by the oil industry:

fertilizer for food production, petroleum to transport food and other

goods to stores, plastics in home products including clothing fibers,

building products like PCV pipes, to the basic power generated by

utilities in the form of electricity. Electricity powers light, heat,

cooling, cooking and appliances that every household takes for granted.

History

is repeat with boom and bust financial cycles. In the past, some major

event pulled the American nation from the brink. Whether it was war

or the home grown industrial invention of the modern conveniences

and middle class consumerism. But the current downturn has significantly

different components, even though it is still a petroleum world.

In

the 1970s, Saudi Arabia and other OPEC nations viewed $35.00/barrel

for crude oil the limit. It was believed that over that amount, Americans

would find it cost efficient to re-drill the reserves within their

borders. OPEC wanted to continue to apply monopoly characteristics

to its oil exports, creating a vast dependency of the industrialized

world. The concept of “petrodollars” found its way into

normal lexicon. The resource rich but poor OPEC countries soon had

vast wealth built on a single commodity: oil. So they kept the price

within a limited range to protect their wealth. Oil is the best indicator

of the economic formula of supply and demand. In the late 1970s, there

were huge oil shortages. Long gas lines crippled America. World leaders

feared that their grasp on the oil fields would be weakened if Americans

has to pay more than $1.00/gallon for gasoline.

At

the same time, food prices remained flatlined; corn prices ranged

from $1.20-$1.80 bushel, depending on weather and crop yields. Farmers

had to scrape by on low corn prices, federal subsidies, set-aside

programs in order to eke out just above poverty wages. Three major

components in a farmer's budget, fertilizer, pesticides and gasoline,

were all greatly increased by oil price spikes.

So

when oil hurdles toward $100.00/barrel, food prices skyrocket. Corn

prices are now between $6.00-7.00 per bushel, a more than 200% increase

from the norm. This is at the same time the federal government continues

to drone that that the U.S. has no inflation. That is because the

government formula takes out the “volatile” elements of

oil and food prices. The average person going to a supermarket knows

that food inflation is running rampant as a grocery basket worth of

items has doubled in price in a few short years. The gas pump also

does not lie: people cannot remember when gasoline was $2.00/gallon

when it is currently trending above $3.40/gallon.

Most

economists will now admit that the average worker's wage (purchasing

power), adjusted for real inflation, has gone down in the past twenty

years. Everything costs more. It used to be April 15 was tax day,

the day during the year that current wages to that time would meet

one's federal, state and local tax obligations. This tax day has moved

quickly into July, as the public burdens on private citizens are now

more than 50% of their real wages.

Adding

to the squeeze in the household budget is that fact that politics

has warped natural business economics. Environmentalists and government

officials have diverted huge amount of fertile cropland to ethanol

production as an alternative means to oil. However, the cost of creating

one gallon of ethanol is quadruple the cost of gasoline. The taxpayers

are subsidizing an extremely cost inefficient energy source, then

paying dramatically more in food prices as a result of human food

crop acreage losses. The government action to support an inefficient

green industry may be a scandal like Tea Pot Dome before the dust

settles.

The

same environmentalists continue to defy a federal court order to allow

deep sea drilling to continue in the Gulf of Mexico. The vast reserves

of oil in the gulf is one means of lessening the dependence on foreign

oil and stabilizing energy prices. But the mantra of No Drilling on

American Soil has taken root with the federal regulators. Those rigs

in the gulf are now gone, to other places throughout the world to

capture that $80.00 plus per barrel black gold.

In

past downturns, America used to be able to “work its way out”

to prosperity. But the hyper bubble bursts of the housing industry

and financial sector meltdown fueled by government misspending has

created a massive sink hole all the way to China. American manufacturing

is hovering around 50% capacity due to massive outsourcing of technology

and assembly to emerging markets. Imports with low tariffs make American

products a disadvantage on store shelves compared to Chinese imports.

The entrepreneurial spirit of risk and reward to start a business

today has been muted by a credit squeeze, high taxes, dense regulations

and cheap imports. For the first time in American business, a majority

of the Fortune 500 companies have made their profits from overseas

operations. The nation is no longer a leader but a follower in creating

goods.

The

federal government on February 14, 2011 did something most people

thought was impossible. The federal deficit toppled the annual Gross

Domestic Product of $13 trillion. The US was officially bankrupt.

It would take a full year of every single penny of goods, services

and private spending to pay off the debt. Debt that does not include

the massive borrowing of state and local governments. In reality,

the US is in the same financial position of tredding-water countries

like Greece, Portugal, and Ireland.

The

United States is still the largest consumer nation. However, the whole

consumer economy is a layered ponzi scheme of credit over savings,

entitlements over work, and growing class warfare between the public

and private sectors. China has stopped using its massive trade surplus

of US dollars to buy US Treasury bonds. The largest “buyer”

of American debt is the Federal Reserve, which makes little common

sense that we are borrowing money from ourselves; money which we don't

have in the first place. But that is the high finance that only a

few government officials believe they know and understand, while the

“financially naive” taxpayer is left to scrabble from paycheck

to paycheck.

During

one past election cycle, a Congressman running for re-election was

ambushed by a question from a reporter. It was a simple one. “What

is the cost of a gallon of milk?” A basic, household staple.

A weekly expense to each and every voter in his district. A true indicator

of the economy at the lowest common denominator. The congressman stumbled

and had no answer. It showed how far out of touch the people who make

laws affecting taxpayer's bread baskets are to the true economic realities

on Main Street America. One gets the feeling that Washington D.C.

elite have an attitude that the people in the heartland “shall

have their cake and eat it too;” a precursor to the French Revolution

of mandates of “do what I say but not as I do.” The current

policy is to continue to import oil at higher and higher prices in

order not to upset the environmental agenda even though it is killing

the average consumer.