cyberbarf

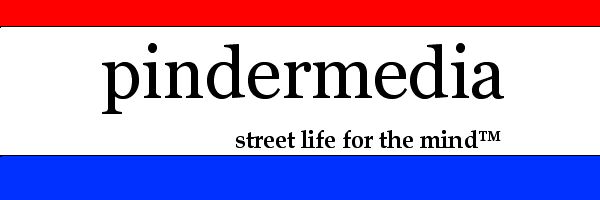

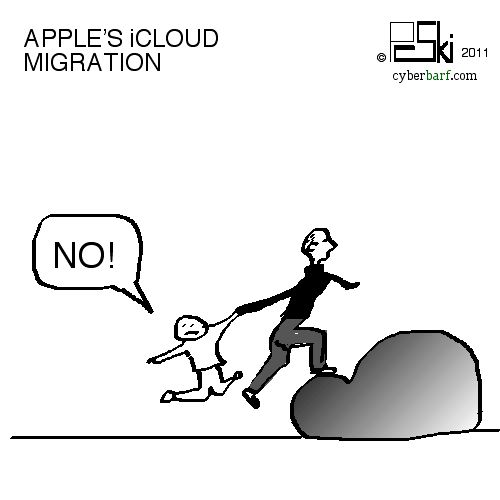

FORCED

MIGRATION ARTICLE

When

Steve Jobs took the stage at Apple's developer's conference, he confirmed

Apple's next great move: total integration of devices via iCloud.

Apparently, the new philosophy is that there is no longer a digital

personal hub, like a desktop or laptop computer. Everything is now

a device. The hub is going to be Apple's new huge data center in North

Carolina. Jobs was frustrated by the steps needed to synch one's devices

together: music from the iPod, pictures from the iPhone, contacts

from a MacBook. So he wants to force feed virtual synchronization

through the iCloud platform.

The

first reaction for attendees and Apple watchers was - - - what if

you don't want all your devices to synch together automatically? There

are some not named Tiger Woods who cringe if their spouse's iPhone

was auto-synched to their email message accounts. This push technology

in many respects is quite, pushy. Jobs is not offering Applephiles

an option to participate in the iCloud universe; he is taking everyone

by the hand and dragging them into the service since it will be the

core feature in the new computer and mobile operating systems, Lion

and iOS 5.

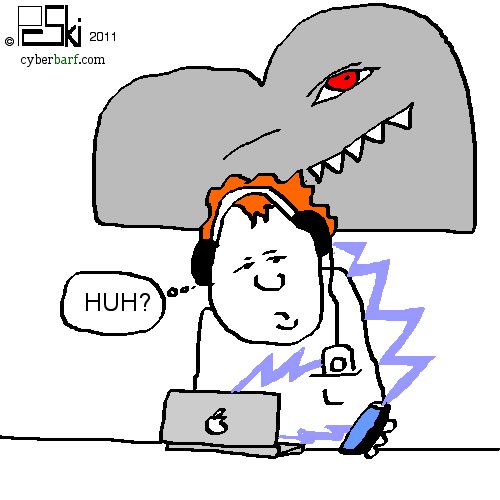

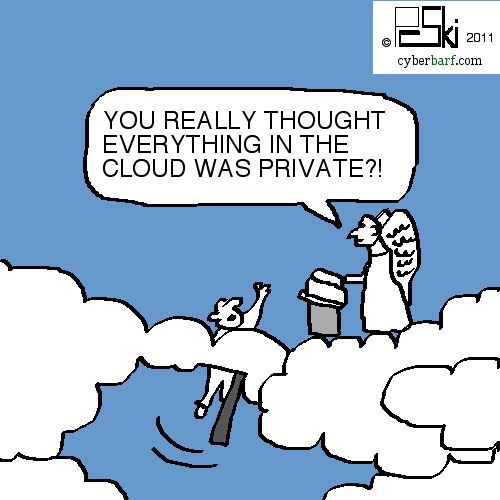

If

people had concerns about Big Brother reading all the stuff on one's

computer devices, what about Big Steve? He really did not address

the basic cloud issues of security, privacy, data reliability, storage

capacity or future pricing. No business is going to give away “free”

cloud storage services when the infrastructure cost is in the multi-million

to billion dollar range.

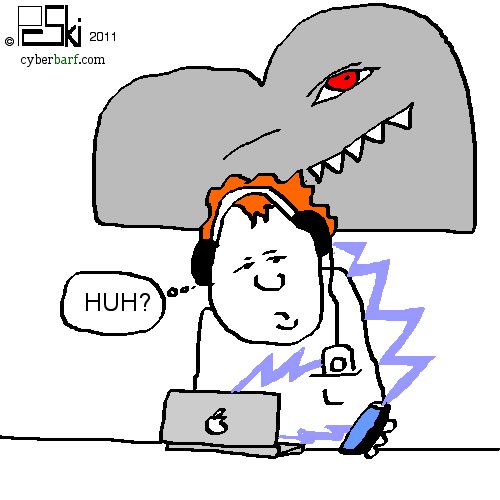

With

large corporations and government agency hacker attacks on the rise,

network security information especially from mobile devices should

be a real concern that should be addressed before a forced migration

of users to a vulnerable platform. Even Apple had to acknowledge recently

that its pristine anti-virus reputation was not infallible to malware

attacks, forcing new security updates.

But

what is the real reason for iCloud? Storing all your information in

a central location for synchronized access across any platform seems

to be an overkill solution for individual laziness. It is also a realignment

of conventional thinking that intellectual property is merely information

and data is merely a new commodity to be harvested, stored and resourced

like cards being shuffled in a deck.

We

still really don't know what the iCloud license agreement will really

say to individual users. How much access will third parties have to

your stored data? Will Apple or third parties take collective bits

of stored information and “secretly” data mine and sell

those results to spam marketers? Recently, Apple was called on the

carpet for collecting cell phone tower information from users to create

central data bases for its GPS mapping services. iPhone users were

not aware that their location information was being secretly collected

by Apple. Apple said no personal information was collected, just the

physical cell tower specifics in order to improve digital switching

as a person moves throughout different cell areas. It is this kind

of miscommunication on how the user experience (and information) can

lead to a great conflict.

Critics

will point to the NC data center as a huge hive of information, constantly

updated by iPhone worker drones (users) who will continually pollinate

it with personal information (creating the valuable honey data bases).

It may be a cynical perspective but the current non-manufacturing

business model in America is squeezing value out of inert data manipulation.

Apple

has been moving its products lines into the mobile crossroad. The

touch screen operating interface is now going to be put into new Lion

MacBooks. There will be resistance to it in the pure business community

where keyboards for word processing is still the most important feature

used on a daily basis. Apple has been pushing sales of new models

by not being backward compatible. A new OS makes the old OS obsolete

in certain respects. Software developers soon stop supporting the

old OS programs to concentrate on the new systems, with their new

feature sets. When you join the Apple bandwagon, you have to hold

on tight, because it is a fast ride.

With

iCloud, the bandwagon is being roped on a Saturn rocket. The ride

is going to be bumpy.

cyberbarf

DE-PANTSING

POLITICIANS COMMENTARY

It is apparent that there are a lot of strange people running

around Congress. Strange as in ego, narcissistic, arrogant and stupid.

Usually at the same time. Usually before and after getting caught

with their pants down.

For

the love of a wrong hash tag, a private message photograph gets into

the public domain.

Rep.

Anthony Weiner (Democrat, New York) is the latest politician caught

with his pants down, literally, in a sext scandal. Weiner first claimed

that his social network accounts were hacked by some unknown villain.

He then stated that someone used his account to send doctored or false

pictures of his underweared groin to co-eds across the country. In

less than ten days, he called an emergency press conference to say

he had lied, that he sent the compromising picture to the co-ed, and

that he had personal (and stressed legal) communications with women

over the internet. He said that he would not resign or take media

questions.

That

led to a Tiger Woods like media feeding frenzy. More women came out

of the wood work to say that Rep. Weiner had been sending them provocative

photographs, like the bare chested warrior pose that many late night

comics splattered across HD TV screens. Rep. Weiner, a former fixture

of a party attack dog on political TV and radio shows, went into hiding

and avoided the media. Weiner, a married man whose spouse is a senior

aide to Secretary of State Hillary Clinton, would be subject to various

calls for his resignation. Republicans caught up in sex scandals resign.

Democrats caught up in sex scandals hold teary eyed press conferences

and hold their ground against critics.

Then

conservative media site maven Andrew Breibart received the naked photograph

of Weiner's, well, wiener. So in short order, the image hit the Internet

Any vague suggestion that these were innocent chats turned into a

dark, pervy story. Just as another sexting story was about to break,

one which would allege Weiner had a relationship with a 17 year old,

Wiener made an announcement that he would go immediately “ into

counseling.”

For

a powerful politician to forcefully deny any story of sexting conduct

two weeks ago, to have to run and hide in a counseling center to avoid

legal or ethical investigations is becoming standard operating procedure

on Capitol Hill. In order to run for office, and the power, money

and perks that our the victors, one must cut loose all ties to morality

or shame. For the spoils of victory, said power, money and perks like

using one's office or title to Internet chat up young women, make

grown men into spoiled, hapless and stupid children.

Anything

digital sent to a social media web site can be copied, printed or

forwarded to any place in the world, including an editor of a news

organization. Politicians such as Wiener must truly believe that they

are above common sense because of their position as a representative

means things that apply to their constituents does not apply to them.

Like “cheating” on their spouse with graphic cyber-relationships

with other women.

And

how dumb was he? The biggest New York sports scandal in a decade was

the Brett Favre sexting scandal. Weiner cannot claim any ignorance

as to the consequences of his actions when his home state, with daily

screaming headlines in the New York tabloids, detailed Favre's misbehavior.

The public turned on the Jet quarterback faster than an unblocked

defensive end coming in for a brutal sack.

Weiner,

by all accounts, is such a pit bull that he will not give up his seat

in Congress. He is a career politician, no real experience in the

private sector. His sole being has been ranting about policy positions

by taking the higher moral ground against his opponents. If that is

the foundation for his political character, it has been crumbling

for weeks. He may have the mental outlook of a punk, cornered by his

own transgressions to turn him into a perv, but he can still represent

the folks in his district. His interests are allegedly aligned with

the votes cast on his behalf. How much embarrassment can his district

take before re-aligning themselves with a new representative? After

Wiener's counseling statement, several New York politicians began

to explore the possibility of unseating him in the next election.

You see, Wiener's self inflicted wounds make him a weak candidate,

and the wolves will be out to hunt him down. That's what career politicians

do: feast on each other's misfortunes for personal gain.

It

is a cycle of deceit that was uncovered by public publication of private

matters on social media sites. It is not a pretty picture what goes

on in the halls of D.C. or what is floating around the social networks.

cyberbarf

THE

AMAZON TAX ARTICLE

Various states have been attempting to have Amazon.com collect state

sales taxes on any sales generated by the Internet retail giant. Amazon

has fought back saying it will not collect or remit sales taxes for

state and local governments because it is burdensome on interstate

commerce. State and local governments are cash starved and they have

been looking to increase tax collections by any means possible to

cover massive budget short falls.

The

U.S. Supreme Court in the Quill decision held that a state

cannot impose a sales tax on a business unless that business had a

real “nexus” to the state in question. Nexus has been defined

as a physical presence in the state. The theory is that if you have

a physical presence in the state, that person or business is like

any other taxpayer receiving state and local governmental services.

In Texas, the state decided to impose collection taxes on Amazon because

it had warehouse facilities. In response, Amazon told the state that

it would leave the state, costing the area hundreds of jobs. Other

states have decided that Amazon affiliates, independent business operators

who direct clients to Amazon, are the physical presence nexus to impose

the sales tax collection on Amazon. Amazon said, no, we do not have

a physical presence in any other those states. But instead of risking

a decision in court, Amazon cut all ties to affiliates in those states.

The affiliates were outraged, not by Amazon, but by their own states

- - - many moving their homes and businesses out of state.

In

theory, states have been collecting “use” taxes on their

own citizens who bring in out-of-state products for which no in-state

sales tax was collected by the retailer. These use taxes are typically

forced upon property that needs to be titled, such as boats, airplanes

and automobiles. But the states define any property purchased by its

citizens fair game for state sales tax collection. Illinois has asked

its own citizens to calculate their own use taxes for all their annual

Internet purchases, to be filed with their annual income tax returns.

The Quill decision left open the question of whether use taxes

are permissible under the US Constitution.

The limits to the right of the public authority to

impose taxes are set by the power that is qualified to do so under

constitutional law. In a democratic system this power is the legislature,

not the executive or the judiciary. The constitutions of some countries

may allow the executive to impose temporary quasi-legislative measures

in time of emergency, however, and under certain circumstances the

executive may be given power to alter provisions within limits set

by the legislature. The legality of taxation has been asserted by

constitutional texts in many countries, including the United States,

France, Brazil, and Sweden. In Great Britain, which has no written

constitution, taxation is also a prerogative of the legislature.

Encyclopedia Britannica, 1999.

In

the United States Declaration of Independence, the rule "no

taxation without consent" laid down. Under this principle, the rights

of the tax administration and the corresponding obligations of the

taxpayer are to be specified in the law adopted by the people's representatives.

However,

there are limitations on the power of taxation by governments. Restraints

on the taxing power are generally imposed by tradition, custom, and

political considerations. Many countries have constitutional limitations.

Certain limitations on the taxing power of the legislature are self-evident.

As a practical matter, as well as a matter of (constitutional) law,

there must be a minimum connection between the subject of taxation

and the taxing power. The extent of income-tax jurisdiction, for example,

is essentially determined by two main criteria: the residence (or

nationality) of the taxpayer and his source of income. (The application

of both criteria together in cases where the taxpayer's residence

and his source of income are in different countries often results

in burdensome double taxation, although the problem can be avoided

or restricted by international treaties.) Encyclopedia

Britannica, 1999.

Taxes

other than income taxes--such as retail-sales taxes, turnover taxes,

death taxes, registration fees, and stamp duties--are imposed by the

authority (national or local) on whose territory the goods are delivered

or the taxable assets are located. Another self-evident limitation

on the taxing power of the public authority is that the same authority

cannot impose the same tax twice on the same person on the same ground.

A common limitation on the taxing power is the requirement that all

citizens be treated alike. This requirement is specified in the US

Constitution. A similar provision in of the constitutions is that

all citizens are equal and that no privileges can be granted in tax

matters. The rule is often violated through the influence of pressure

groups, however; it is also difficult to enforce and to interpret

unambiguously. In countries in which local governments are under the

control of the national government, a local tax can be nullified by

the central authority on the ground that it violates the national

constitution if it transgresses the rule of uniformity and equality

of taxpayers. Encyclopedia

Britannica, 1999.

The

United States Constitution is clear on taxation limitations. Article

IV deals, in part, with relations among the states and privileges

of the citizens of the states, The commerce clause (Article I, section

8) simply authorizes Congress “To regulate Commerce with foreign

Nations, and among the several States, and with the Indian Tribes.”

Since

Gibbons v. Ogden (1824), the US Supreme Court has broadly interpreted

Congress' regulatory power under the commerce clause as new methods

of interstate transportation and communication have come into use.

States may not regulate any aspect of interstate commerce that Congress

has preempted. However, at times, the courts do not view past precedent

and constitutional language in context with the framer's original

intent.

In

the US Constitution, Article I, Section 8 states:

“The

Congress shall have Power To lay and collect Taxes, Duties, Imposts

and Excises, to pay the Debts and provide for the common Defence and

general Welfare of the United States; but all Duties, Imposts and

Excises shall be uniform throughout the United States;

“To

regulate Commerce with foreign Nations, and among the several States,

and with the Indian Tribes.”

America

had just completed a revolution to break away from England. One of

the objectives of the revolution was to break the burdensome and penal

quality of taxation imposed upon the colonists, who had no right to

petition or object to the imposition of any tax by the crown. “Taxation

without representation” was a battle cry to the founding fathers.

But one must realize, that most of the founding fathers were wealthy

and successful merchants, farmers and businessmen. In certain respects,

there were on the front lines of harsh government taxation by the

King. They understood that heavy taxation took capital out of the

colonies and exported the means of independence and grown to the treasury

of the King and his parliament.

At

the time, sovereigns collected taxes on products such as imports.

These duties or stamp taxes were imposed by revenue collectors on

all merchants or suppliers as the ships docked in a port. The economic

engine of the world in the 1700s was global trade. Every barrel of

tea, wine or rum landing in Boston Harbor was taxed by the crown for

the privilege of bringing it ashore for resale or personal consumption.

This was an easy and efficient means of collecting taxes. So much

so, that the taxing authorities continued to increase the rate of

tax until the people had enough.

Just

as the various colonies had issues with England in regard to the taxation

of commerce and import fees, it was also an issue (or a potential

powder keg) between the colonies themselves. In the Confederation

of original States, there was animosity between the wealthy states

(such as Virginia) and the rural states in regard to free flow of

goods. A wealthy state could impose a tariff or tax on a rural state's

farm goods so as to penalize the import or protect their own merchant

farmers from competition. These border conflicts would be as ripe

as the American revolution over time. The founding fathers believed

that in order for their independence to be assured, all the new States

had to band together for their mutual protection against the European

superpowers of their time. As such, they put clear limitations on

interstate taxation in the final Constitution:

Article

I, Section 9 states:

“No

Tax or Duty shall be laid on Articles exported from any State.

“No

Preference shall be given by any Regulation of Commerce or Revenue

to the Ports of one State over those of another; nor shall Vessels

bound to, or from, one State, be obliged to enter, clear, or pay Duties

in another.”

This

constitutional provision clearly states that one state cannot tax

another state's goods from entering its borders. Likewise, a citizen

of one state would not be obligated to pay a tax in his home state

for purchases he made in another state. And in order to keep this

free commerce provision from loopholes, the following provisions were

adopted:

Article

I, Section 10 states:

“

No State shall, without the Consent of the Congress, lay any Imposts

or Duties on Imports or Exports, except what may be absolutely necessary

for executing it's inspection Laws: and the net Produce of all Duties

and Imposts, laid by any State on Imports or Exports, shall be for

the Use of the Treasury of the United States; and all such Laws shall

be subject to the Revision and Control of the Congress.”

This

meant that even if a State started collecting import duties and taxes,

all those moneys belonged to the federal government. The sole source

of revenue for the federal government was tariffs on international

goods. Clearly, the states did not have any room to craft interstate

commerce taxes.

And

if read in conjunction with other provisions, this ban on interstate

taxation applies to individuals.

Article

IV Section 2 clearly states: “The Citizens of each State shall

be entitled to all Privileges and Immunities of Citizens in the several

States. ”

The

9th Amendment states “The enumeration in the Constitution, of

certain rights, shall not be construed to deny or disparage others

retained by the people.”

The 10th Amendment states “The powers not delegated to the United

States by the Constitution, nor prohibited by it to the States, are

reserved to the States respectively, or to the people.”

If

you are a citizen of Virginia and purchased a cow in Maryland, which

imposed no sales tax on the transaction, Virginia could not penalize

or charge you a cow tax when you brought your cow back to Virginia.

That would be an improper tax on interstate commerce. It would also

be an infringement of a person's rights and privileges while conducting

business in Maryland where no sales tax for that transaction. The

prohibition of government interference with contracts was clearly

an issue the founding fathers thought paramount to establishing a

sound movement of goods and services between the new States. To allow

a state to tax any citizen, including their own residents, for out-of-state

purchases is clearly an unconstitutional burden on interstate commerce

when one reads the constitution as a whole, and in context.